Pegged exchange rate system pdf

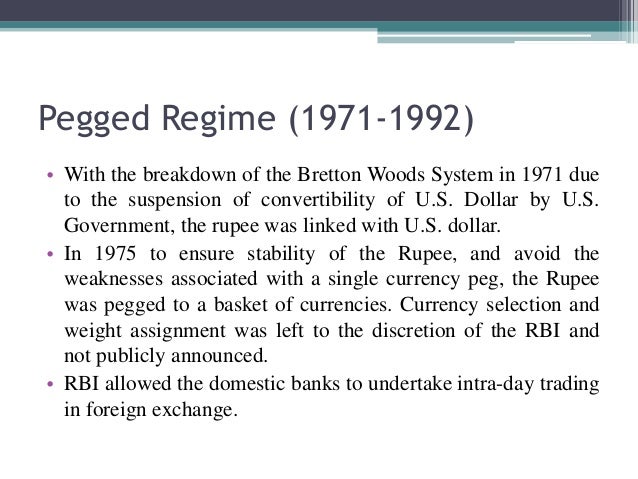

Monetary Policy and Reserves Management under Pegged Exchange Rate Arrangement: Nepal’s Experience Paper presented by Dr. Yuba Raj Khatiwada, Governor, Nepal Rastra Bank at a program organized by Royal Monetary Authority of Bhutan, Thimphu 28 August 2014 Background 1. After the breakdown of the Bretton Wood system in 1973, many advanced countries have adopted the market determined exchange

Government Intervention – Download as Powerpoint Presentation (.ppt), PDF File (.pdf), Text File (.txt) or view presentation slides online. International Finance and Trade

External Shocks and Collapsing the Pegged Exchange Rate System† Hua Yu Sun (孙华妤)a, b and Yue Ma (马跃)a, c* a Associate Professor, Department of Economics,

Such an adjustment in the dollar’s value should _____ the U. dollar are part of a: A) pegged system. fixed rate D) fixed rate. increase B) weakening. . D) establishing that exchange rates of most major currencies were to be allowed to fluctuate freely without boundaries (although the central banks did have the right to intervene when necessary). A) floating rate. B) establishing specific

Flexible Exchange Rate in the 1950s: Valuable Lessons Learned Lawrence Schembri, International Department • Canada’s lengthy experience with a flexible exchange rate regime has had an important impact on the development of macroeconomic theory and policy in open economies. • This article focuses on the 1950–62 floating-rate period because the flexible exchange rate, combined with a

exchange rate system is that it allows countries autonomy with respect to their use of monetary, fiscal and other policy instruments and at the sametime external equilibrium is ensured because of flexible exchange rate.

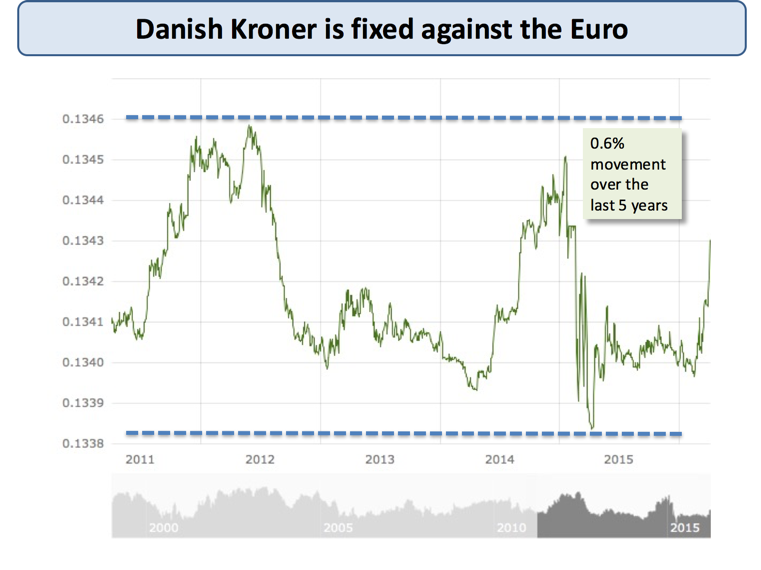

board arrangements, other conventional fixed peg arrangements, pegged exchange rates within horizontal bands and conventional pegs. “Crawling peg” includes exchange rates within crawling bands, crawling pegs and crawl-like arrangements.

When the Bretton Woods system of fixed exchange rates failed in 1973, Australia’s banks and capital markets were underdeveloped compared to those in America and the U.K. Fearing instability in the Australian banking system, authorities decided to retain a fixed exchange rate.

The IMF exchange rate classification (1983-1998) broadly divides the exchange rate regim es into four catego ries: f ixed, flexibility limited (cr awlin g peg), m anaged f loat (d irty f loat), and independent float.

115 AN ANALYSIS OF PEGGED EXCHANGE RATE BETWEEN BHUTAN AND INDIA Karma Galey* Abstract This paper analyzes the applicability of the theory of optimum

wish to peg their exchange rates but sometimes have floating rates thrust upon them. On three occasions during the twentieth century—the breakup of the international gold standald in the l930s, the breakup of the Bretton Woods system in the 1970s and most recently the exo-dus of countries (notably Britain) from the ex-change rate mechanism (ERM) of the European Economic Community (EEC

oecd economic studies no . 26 . 1996a vulnerability of fixed exchange rate regimes: the role of economic fundamentals norbert funke table of contents

Floating Exchange Rates: Experience and Prospects WITH THE ABANDONMENT of fixed dollar exchange rates in March 1973, the world’s industrialized countries adopted temporarily a system …

A fixed exchange rate is when a country ties the value of its currency to some other widely-used commodity or currency. The dollar is used for most transactions in international trade. Today, most fixed exchange rates are pegged to the U.S. dollar. Countries also fix their currencies to that

This system is known as the par value system of pegged exchange rate system. Under this system, each member country of the IMF was required to define the value of its currency in terms of gold or the US dollar and maintain (or peg) the market value of its currency within ± …

FEDERAL RESERVE BANK OF ST. LOUIS 2. By spreading exchange rate adjustments over long periods, the “crawling peg” system would avoid the periodic exchange crises and un-

0 of Exchange Rate Regimes Developing Countries

Mr Alweendo discusses Namibia’s current exchange rate

1 Appendix II: Fixed vs Flexible Exchange Rates There have been discussions about the optimal exchange rate regime for a very long time, reflecting the evolution of the world economy and the conduct of monetary policy.

flexible) exchange rates can be thought of as an exchange rate band with in- finite bounds, while a system of pure fixed (or pegged) rates is a band with zero bounds.

The period 1947-1971 came to be known as ‘fixed but adjustable exchange rate system’ or ‘par value system’ or the ‘pegged exchange rate system’ or the ‘Bretton Woods System’. ADVERTISEMENTS:

that the terms fi xed exchange rate and pegged exchange rate are used synonymously in this book, as are fl exible exchange rate and fl oating exchange rate. Source: Authors’ illustration.

greater policy discipline imposed by the regime. Even a pegged exchange rate country with an initially high inflation will eventually, through the discipline effect, enjoy a low inflation rate.

That is why, IMF has adopted pegged or fixed exchange rate system. (iii) It encourages multilateral trade through regional cooperation of different countries. (iv) In modern times when economic transactions and relations among nations have become too vast and complex, it is more useful to follow a fixed exchange rate system.

42 piece of the new system, the ERM? In the view of British monetary authorities, the loss of room for maneuvering under a system of pegged exchange rates outweighed probable gains.

Fixed exchange rate regime: • In the medium run, the real exchange rate is determined by the relative price of foreign to domestic goods, regardless of regime.

pegged exchange rates, the nominal rupee-dollar exchange rate has had low volatility, while all other measures of the exchange rate have been more volatile. The rupee-dollar spot market is a pegged exchange rate.

history of exchange rate arrangements. When the official categorization is a form of peg, quite When the official categorization is a form of peg, quite frequently—roughly half the time—our classification reveals the true underlying monetary

Pegged Exchange-Rate Arrangement a. but some nations maintain more stable exchange rates by tying their currencies to other currencies 1. Many small countries peg their currencies to the dollar. currency realignments were infrequent and inflation was controlled. they created the European monetary system (EMS) to stabilize exchange rates. there emerged several efforts to manage exchange rates

versus (2) a rigid peg to the euro, versus (3) a rigid peg to the yen, versus (4) a rigid peg to the price of the leading export commodity of the country in question. The study offers a new proposal, called PEP, for Peg the Export Price.

system is at best subordinated to exchange rate policy, as domestic credit creation must be kept within limits in order to ensure a sufficient volume of net foreign assets of the banking system. In monetary

pegged exchange rates in the early 1970s and the emergence of capital account crises in the 1990s on the back of rapid growth in private capital flows. A defining change was the breakdown of the Bretton Woods system of

stock which, under a pegged system, is endogenous. A large literature (for instance, see Frenkel 1976, Branson and Henderson 1985, Frenkel and Mussa 1985, Mark 1985, McDonald 1999, and Sarno and Taylor 2002) suggests that the money demand- supply relationship is a key determinant of the exchange rate under a floating regime. On the real side, a feature the Australian economy shares with many

focus is on the “modern era” since the Bretton Woods system (of widespread pegged exchange rates) finally collapsed in 1973. The authors provide a simple theoretical framework for their

A complete list of all countries with fixed or pegged currency exchange rates, along with the exchange rate, target currency, and more! Investor’s List: Countries with Fixed Currency Exchange Rates. By. Shalifay – Feb 19, 2013 . 89239. We’ve touched on the impact that currency risks can have on frontier market investments before, but countries with fixed exchange rates present a unique

A pegged exchange rate, the maintenance of which meant monetary policy was not free to set domestic interest rates, because intervention to offset pressure on the exchange rate’s level involved buying or selling New Zealand dollars,

exchange rate regime in the first half of the 1990s, the five East Asian na- tions that eventually ran into a crisis in 1997 had a rigid—de facto, pegged, or quasi pegged—exchange rate system …

country which pegged its exchange rate to gold, the others set their parities in terms of dollars and intervened in the dollar market. Thus the system evolved into

Difference Between Fixed and Flexible Exchange Rates (with

Thus, I argue in section IV, that a system focusing on official exchange rate behavior is the appropriate one for the issue at hand. Once it is established which country/year observations should be considered pegged and which

Article (PDF Available) been operating under pegged exchange rate system of one kind or another. (1996) t hat under a floating exchange rate regime, exchange rate changes . are less highly

An exchange rate for a currency where the government has decided to link the value to another currency or to some valuable commodity like gold. For example, under the Bretton Woods System, most world currencies fixed themselves to the U.S. dollar, which in turn fixed itself to gold.

Brazilian case, the exchange rate system was a managed peg, or what is normally called a crawling peg. That is, the country moved the value of the new currency by a target amount, estimated at 8

Current Malaysia Exchange Rate System. Malaysia pegged the RM to USD for almost the period of 1998/2005. This current year the currency of Malaysia are free again. Even though it is free but it still not entirely free. The ringgit is free but not floating freely. It is now under “managed” float. Cynics would call it “dirty” float. To them, a “clean” float is synonymous with a

A fixed exchange rate is a regime applied by a country whereby the government or central bank ties the official exchange rate to another country’s currency or the price of gold. The purpose of a – can i change a work document into a jpeg Some of the major types of foreign exchange rates are as follows: 1. Fixed Exchange Rate System 2. Flexible Exchange Rate System 3. Managed Floating Rate System. 1. Fixed Exchange Rate System (or Pegged Exchange Rate System). Fixed exchange rate system refers to a system in which exchange rate for a

system. Accordingly, the attack on the Argentine peso during the Mexican crisis of 1994–95 caused a full-fledged banking crisis. The fixed exchange rate survived. The banks did not. Furthermore, Ar- gentina’s success in keeping its exchange rate fixed did not protect it four years later, when the Brazilian crisis of 1998–99 triggered an-other attack on the Argentine peso. Fixed Exchange

3 1. INTRODUCTION The issue of the regime governing the Chinese exchange rate — and specifically whether the currency is moving away from the de facto peg that for ten years has tied it to

Of course, exchange rates do vary daily under a floating rate system. But international financial markets have developed to allow firms the opportunity to hedge risks associated with these changes.

(1999) that exits from pegged exchange rate regimes have been accompanied by output declines. In addition, they show that exits from long-lasting pegs, both orderly and disorderly, appear to be accompanied by particularly large falls in economic activity.

The Mexican Peso Crisis: Exchange Rate Policy and Financial System Management by Brian Kingston An Honours essay submitted to Carleton University in fulfillment

Bretton Woods system preferred pegged exchange rate and monetary independence disregarding extensive capital control and, as a result, the system collapsed in the face of increasing capital mobility.

A pegged exchange rate system is a hybrid of fixed and floating exchange rate regimes. Typically, a country will “peg” its currency to a major currency such as the U.S. dollar, or to a basket of

Definition of Fixed Exchange Rate. An exchange rate regime, also known as the pegged exchange rate, wherein the government and central bank attempts to keep the value of the currency is fixed against the value of other currencies, is called fixed exchange rate.

3 ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A GENERAL EQUILIBRIUM PERSPECTIVE INTRODUCTION As of February 1994, the Bank of Latvia pegged …

Save. A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime in which a currency’s value is fixed against either the value of another single currency to a basket of other currencies or to another measure of value, such as gold.

Choice Of Exchange Rate Regimes For Developing Countries April 2001 Africa Region Working Paper Series No. 16 Abstract The choice of an appropriate exchange rate …

Pegged exchange rates within horizontal bands The value of the currency is maintained within certain margins of fluc- tuation of at least ±1 percent around a fixed central rate, or the margin

choosing an exchange rate regime for vietnam Vietnam experienced hyperinflation in the 1980s, and now, inflationary tendency has come back since 2004 due to some external and internal factors.

Fixed exchange rates: A metallic standard leads to fixed exchange rates. In a gold standard, each country determines the gold parity of its currency, which fixes the exchange rates between countries. In a reserve currency system, the reserve currency has a gold parity, and all other currencies are pegged to the reserve currency, which also leads to fixed exchange rates. Fixed exchange rates

Fixed exchange-rate system Revolvy

An exchange-rate regime is the way an authority manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, elasticity of labor market, financial market

a pegged exchange rate. With interest rates, in real terms, generally held quite low there was a fairly heavy reliance 4 Unsurprisingly, the REER was a lot more stable during this period, as the adjustment to nominal exchange rate was made to offset inflation differentials. 5 For a comprehensive overview of past monetary regimes in New Zealand, see Monetary Policy and the New Zealand Financial

In order to maintain a pegged exchange rate, a central bank must maintain a high level of currency reserves. The existence and argument for these types of pegged rates is that the pegged exchange rate facilitates trade and investment between the two countries with the pegged currencies.

exchange rate system of the structural adjustment years had been abandoned, and a system of fixed or pegged exchange rates instituted. However, following the …

exchange rate system, a nation with a higher rate of inflation than the rest of the world is likely to face persistent deficits in its balance of payments resulting in loss of reserves. Due to the unsustainability of the persistent deficits and reserve losses, the nation needs

Fixed Exchange Rate Definition Pros Cons Examples

IXED VERSUS LOATING XCHANGE ATES Peter B. Kenen

The Operation and Demise of the Bretton Woods System 1958

Floating Exchange Rates Experience and Prospects

Canada’s Experience with a Flexible Exchange Rate in the

HISTORY OF MALAYSIAN EXCHANGE RATE Academia.edu

A Comparative Analysis of the Impact of the Fixed and

comment convertir un document word en image jpeg – AN ANALYSIS OF PEGGED EXCHANGE RATE BETWEEN BHUTAN

What are the main advantages and disadvantages of Fixed

Exchange rate fluctuations How has the regime mattered?

ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A

What are the main advantages and disadvantages of Fixed

HISTORY OF MALAYSIAN EXCHANGE RATE Academia.edu

An exchange rate for a currency where the government has decided to link the value to another currency or to some valuable commodity like gold. For example, under the Bretton Woods System, most world currencies fixed themselves to the U.S. dollar, which in turn fixed itself to gold.

Bretton Woods system preferred pegged exchange rate and monetary independence disregarding extensive capital control and, as a result, the system collapsed in the face of increasing capital mobility.

42 piece of the new system, the ERM? In the view of British monetary authorities, the loss of room for maneuvering under a system of pegged exchange rates outweighed probable gains.

versus (2) a rigid peg to the euro, versus (3) a rigid peg to the yen, versus (4) a rigid peg to the price of the leading export commodity of the country in question. The study offers a new proposal, called PEP, for Peg the Export Price.

Article (PDF Available) been operating under pegged exchange rate system of one kind or another. (1996) t hat under a floating exchange rate regime, exchange rate changes . are less highly

A pegged exchange rate system is a hybrid of fixed and floating exchange rate regimes. Typically, a country will “peg” its currency to a major currency such as the U.S. dollar, or to a basket of

Thus, I argue in section IV, that a system focusing on official exchange rate behavior is the appropriate one for the issue at hand. Once it is established which country/year observations should be considered pegged and which

pegged exchange rates in the early 1970s and the emergence of capital account crises in the 1990s on the back of rapid growth in private capital flows. A defining change was the breakdown of the Bretton Woods system of

Chapter III CHOOSING AN EXCHANGE RATE REGIME FOR VIETNAM

What are the main advantages and disadvantages of Fixed

Brazilian case, the exchange rate system was a managed peg, or what is normally called a crawling peg. That is, the country moved the value of the new currency by a target amount, estimated at 8

greater policy discipline imposed by the regime. Even a pegged exchange rate country with an initially high inflation will eventually, through the discipline effect, enjoy a low inflation rate.

Fixed exchange rate regime: • In the medium run, the real exchange rate is determined by the relative price of foreign to domestic goods, regardless of regime.

The period 1947-1971 came to be known as ‘fixed but adjustable exchange rate system’ or ‘par value system’ or the ‘pegged exchange rate system’ or the ‘Bretton Woods System’. ADVERTISEMENTS:

Fixed vs Flexible Exchange Rate MIT

IB4_IM_CH10.pdf Fixed Exchange Rate System Scribd

When the Bretton Woods system of fixed exchange rates failed in 1973, Australia’s banks and capital markets were underdeveloped compared to those in America and the U.K. Fearing instability in the Australian banking system, authorities decided to retain a fixed exchange rate.

Floating Exchange Rates: Experience and Prospects WITH THE ABANDONMENT of fixed dollar exchange rates in March 1973, the world’s industrialized countries adopted temporarily a system …

A fixed exchange rate is when a country ties the value of its currency to some other widely-used commodity or currency. The dollar is used for most transactions in international trade. Today, most fixed exchange rates are pegged to the U.S. dollar. Countries also fix their currencies to that

exchange rate system is that it allows countries autonomy with respect to their use of monetary, fiscal and other policy instruments and at the sametime external equilibrium is ensured because of flexible exchange rate.

3 ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A GENERAL EQUILIBRIUM PERSPECTIVE INTRODUCTION As of February 1994, the Bank of Latvia pegged …

The period 1947-1971 came to be known as ‘fixed but adjustable exchange rate system’ or ‘par value system’ or the ‘pegged exchange rate system’ or the ‘Bretton Woods System’. ADVERTISEMENTS:

Government Intervention – Download as Powerpoint Presentation (.ppt), PDF File (.pdf), Text File (.txt) or view presentation slides online. International Finance and Trade

greater policy discipline imposed by the regime. Even a pegged exchange rate country with an initially high inflation will eventually, through the discipline effect, enjoy a low inflation rate.

A pegged exchange rate, the maintenance of which meant monetary policy was not free to set domestic interest rates, because intervention to offset pressure on the exchange rate’s level involved buying or selling New Zealand dollars,

system is at best subordinated to exchange rate policy, as domestic credit creation must be kept within limits in order to ensure a sufficient volume of net foreign assets of the banking system. In monetary

oecd economic studies no . 26 . 1996a vulnerability of fixed exchange rate regimes: the role of economic fundamentals norbert funke table of contents

FEDERAL RESERVE BANK OF ST. LOUIS 2. By spreading exchange rate adjustments over long periods, the “crawling peg” system would avoid the periodic exchange crises and un-

115 AN ANALYSIS OF PEGGED EXCHANGE RATE BETWEEN BHUTAN AND INDIA Karma Galey* Abstract This paper analyzes the applicability of the theory of optimum

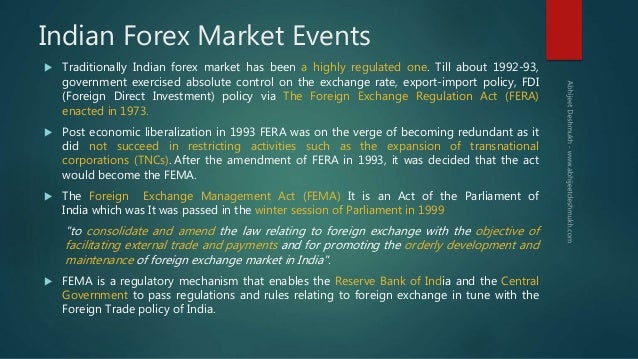

pegged exchange rates, the nominal rupee-dollar exchange rate has had low volatility, while all other measures of the exchange rate have been more volatile. The rupee-dollar spot market is a pegged exchange rate.

Exchange Rate Regime Does it Matter for Inflation?

0 of Exchange Rate Regimes Developing Countries

In order to maintain a pegged exchange rate, a central bank must maintain a high level of currency reserves. The existence and argument for these types of pegged rates is that the pegged exchange rate facilitates trade and investment between the two countries with the pegged currencies.

Definition of Fixed Exchange Rate. An exchange rate regime, also known as the pegged exchange rate, wherein the government and central bank attempts to keep the value of the currency is fixed against the value of other currencies, is called fixed exchange rate.

External Shocks and Collapsing the Pegged Exchange Rate System† Hua Yu Sun (孙华妤)a, b and Yue Ma (马跃)a, c* a Associate Professor, Department of Economics,

A fixed exchange rate is a regime applied by a country whereby the government or central bank ties the official exchange rate to another country’s currency or the price of gold. The purpose of a

system is at best subordinated to exchange rate policy, as domestic credit creation must be kept within limits in order to ensure a sufficient volume of net foreign assets of the banking system. In monetary

choosing an exchange rate regime for vietnam Vietnam experienced hyperinflation in the 1980s, and now, inflationary tendency has come back since 2004 due to some external and internal factors.

This system is known as the par value system of pegged exchange rate system. Under this system, each member country of the IMF was required to define the value of its currency in terms of gold or the US dollar and maintain (or peg) the market value of its currency within ± …

XCHANGE ATE YSTEMS IN ERSPECTIVE Alan C. Stockman

NPTEL International Finance

Thus, I argue in section IV, that a system focusing on official exchange rate behavior is the appropriate one for the issue at hand. Once it is established which country/year observations should be considered pegged and which

Floating Exchange Rates Experience and Prospects

A pegged exchange rate, the maintenance of which meant monetary policy was not free to set domestic interest rates, because intervention to offset pressure on the exchange rate’s level involved buying or selling New Zealand dollars,

Chapter III CHOOSING AN EXCHANGE RATE REGIME FOR VIETNAM

Bretton Woods system preferred pegged exchange rate and monetary independence disregarding extensive capital control and, as a result, the system collapsed in the face of increasing capital mobility.

Monetary Policy and Reserves Management under Pegged

versus (2) a rigid peg to the euro, versus (3) a rigid peg to the yen, versus (4) a rigid peg to the price of the leading export commodity of the country in question. The study offers a new proposal, called PEP, for Peg the Export Price.

HAS AUSTRALIA’S FLOATING EXCHANGE RATE REGIME BEEN

What are the main advantages and disadvantages of Fixed

The period 1947-1971 came to be known as ‘fixed but adjustable exchange rate system’ or ‘par value system’ or the ‘pegged exchange rate system’ or the ‘Bretton Woods System’. ADVERTISEMENTS:

NPTEL International Finance

Monetary Policy and Reserves Management under Pegged Exchange Rate Arrangement: Nepal’s Experience Paper presented by Dr. Yuba Raj Khatiwada, Governor, Nepal Rastra Bank at a program organized by Royal Monetary Authority of Bhutan, Thimphu 28 August 2014 Background 1. After the breakdown of the Bretton Wood system in 1973, many advanced countries have adopted the market determined exchange

Exchange rate fluctuations How has the regime mattered?

ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A

Fixed exchange-rate system Revolvy

External Shocks and Collapsing the Pegged Exchange Rate System† Hua Yu Sun (孙华妤)a, b and Yue Ma (马跃)a, c* a Associate Professor, Department of Economics,

Exchange rate fluctuations How has the regime mattered?

Fixed Float or Intermediate Research Papers in Economics

Exchange-rate regime Wikipedia

that the terms fi xed exchange rate and pegged exchange rate are used synonymously in this book, as are fl exible exchange rate and fl oating exchange rate. Source: Authors’ illustration.

Government Intervention Fixed Exchange Rate System

ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A

Economic Papers Series Paper No. (1) dof.gov.ae

stock which, under a pegged system, is endogenous. A large literature (for instance, see Frenkel 1976, Branson and Henderson 1985, Frenkel and Mussa 1985, Mark 1985, McDonald 1999, and Sarno and Taylor 2002) suggests that the money demand- supply relationship is a key determinant of the exchange rate under a floating regime. On the real side, a feature the Australian economy shares with many

IB4_IM_CH10.pdf Fixed Exchange Rate System Scribd

IXED VERSUS LOATING XCHANGE ATES Peter B. Kenen

Brazilian case, the exchange rate system was a managed peg, or what is normally called a crawling peg. That is, the country moved the value of the new currency by a target amount, estimated at 8

Exchange-rate regime Wikipedia

PDF Appendix II Fixed vs Flexible Exchange Rates

ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A

The IMF exchange rate classification (1983-1998) broadly divides the exchange rate regim es into four catego ries: f ixed, flexibility limited (cr awlin g peg), m anaged f loat (d irty f loat), and independent float.

External Shocks and Collapsing the Pegged Exchange Rate System

Canada’s Experience with a Flexible Exchange Rate in the

42 piece of the new system, the ERM? In the view of British monetary authorities, the loss of room for maneuvering under a system of pegged exchange rates outweighed probable gains.

315791955-Madura-Chapter-6.pdf Fixed Exchange Rate

focus is on the “modern era” since the Bretton Woods system (of widespread pegged exchange rates) finally collapsed in 1973. The authors provide a simple theoretical framework for their

Pegged Exchange Rate Definition & Example InvestingAnswers

A fixed exchange rate is when a country ties the value of its currency to some other widely-used commodity or currency. The dollar is used for most transactions in international trade. Today, most fixed exchange rates are pegged to the U.S. dollar. Countries also fix their currencies to that

VULNERABILITY OF FIXED EXCHANGE RATE REGIMES THE OECD

New Zealand History of Monetary and Exchange Rate Regimes

Article (PDF Available) been operating under pegged exchange rate system of one kind or another. (1996) t hat under a floating exchange rate regime, exchange rate changes . are less highly

Exchange rate fluctuations How has the regime mattered?

Government Intervention Fixed Exchange Rate System

HISTORY OF MALAYSIAN EXCHANGE RATE Academia.edu

exchange rate system, a nation with a higher rate of inflation than the rest of the world is likely to face persistent deficits in its balance of payments resulting in loss of reserves. Due to the unsustainability of the persistent deficits and reserve losses, the nation needs

Australia’s Transition to Floating Exchange Rate System

Investor’s List Countries with Fixed Currency Exchange Rates

Economic Papers Series Paper No. (1) dof.gov.ae

Floating Exchange Rates: Experience and Prospects WITH THE ABANDONMENT of fixed dollar exchange rates in March 1973, the world’s industrialized countries adopted temporarily a system …

The Modern History of Exchange Rate Arrangements

XCHANGE ATE YSTEMS IN ERSPECTIVE Alan C. Stockman

Difference Between Fixed and Flexible Exchange Rates (with

42 piece of the new system, the ERM? In the view of British monetary authorities, the loss of room for maneuvering under a system of pegged exchange rates outweighed probable gains.

The Brazilian Exchange Rate Conundrum RealClearMarkets

The Operation and Demise of the Bretton Woods System 1958

Canada’s Experience with a Flexible Exchange Rate in the

Flexible Exchange Rate in the 1950s: Valuable Lessons Learned Lawrence Schembri, International Department • Canada’s lengthy experience with a flexible exchange rate regime has had an important impact on the development of macroeconomic theory and policy in open economies. • This article focuses on the 1950–62 floating-rate period because the flexible exchange rate, combined with a

IXED VERSUS LOATING XCHANGE ATES Peter B. Kenen

Exchange-rate regime Wikipedia

ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A

choosing an exchange rate regime for vietnam Vietnam experienced hyperinflation in the 1980s, and now, inflationary tendency has come back since 2004 due to some external and internal factors.

International Monetary Reform and the ‘Crawling Peg’

(PDF) Floating Exchange Rate Regime ResearchGate

IXED VERSUS LOATING XCHANGE ATES Peter B. Kenen

Flexible Exchange Rate in the 1950s: Valuable Lessons Learned Lawrence Schembri, International Department • Canada’s lengthy experience with a flexible exchange rate regime has had an important impact on the development of macroeconomic theory and policy in open economies. • This article focuses on the 1950–62 floating-rate period because the flexible exchange rate, combined with a

Canada’s Experience with a Flexible Exchange Rate in the

exchange rate system of the structural adjustment years had been abandoned, and a system of fixed or pegged exchange rates instituted. However, following the …

Mr Alweendo discusses Namibia’s current exchange rate

Investor’s List Countries with Fixed Currency Exchange Rates

that the terms fi xed exchange rate and pegged exchange rate are used synonymously in this book, as are fl exible exchange rate and fl oating exchange rate. Source: Authors’ illustration.

International Monetary Reform and the ‘Crawling Peg’

3 ADVANTAGES OF FIXED EXCHANGE RATE REGIME FROM A GENERAL EQUILIBRIUM PERSPECTIVE INTRODUCTION As of February 1994, the Bank of Latvia pegged …

VULNERABILITY OF FIXED EXCHANGE RATE REGIMES THE OECD

1 Appendix II: Fixed vs Flexible Exchange Rates There have been discussions about the optimal exchange rate regime for a very long time, reflecting the evolution of the world economy and the conduct of monetary policy.

Fixed vs. Pegged Exchange Rate Systems Investopedia

The advantages and disadvantages of various exchange rate

Economic Roundup The Treasury

Fixed exchange rates: A metallic standard leads to fixed exchange rates. In a gold standard, each country determines the gold parity of its currency, which fixes the exchange rates between countries. In a reserve currency system, the reserve currency has a gold parity, and all other currencies are pegged to the reserve currency, which also leads to fixed exchange rates. Fixed exchange rates

0 of Exchange Rate Regimes Developing Countries

Canada’s Experience with a Flexible Exchange Rate in the

Mr Alweendo discusses Namibia’s current exchange rate

An exchange rate for a currency where the government has decided to link the value to another currency or to some valuable commodity like gold. For example, under the Bretton Woods System, most world currencies fixed themselves to the U.S. dollar, which in turn fixed itself to gold.

Mr Alweendo discusses Namibia’s current exchange rate

Fixed exchange rate financial definition of fixed exchange

42 piece of the new system, the ERM? In the view of British monetary authorities, the loss of room for maneuvering under a system of pegged exchange rates outweighed probable gains.

A World of Multiple Monies PIIE

A Comparative Analysis of the Impact of the Fixed and

1 Appendix II: Fixed vs Flexible Exchange Rates There have been discussions about the optimal exchange rate regime for a very long time, reflecting the evolution of the world economy and the conduct of monetary policy.

The Mexican Peso Crisis Exchange Rate Policy and

A World of Multiple Monies PIIE

New Zealand History of Monetary and Exchange Rate Regimes

pegged exchange rates in the early 1970s and the emergence of capital account crises in the 1990s on the back of rapid growth in private capital flows. A defining change was the breakdown of the Bretton Woods system of

Economic Papers Series Paper No. (1) dof.gov.ae

Definition of Fixed Exchange Rate. An exchange rate regime, also known as the pegged exchange rate, wherein the government and central bank attempts to keep the value of the currency is fixed against the value of other currencies, is called fixed exchange rate.

PDF Appendix II Fixed vs Flexible Exchange Rates

Economic Papers Series Paper No. (1) dof.gov.ae

What are the main advantages and disadvantages of Fixed

flexible) exchange rates can be thought of as an exchange rate band with in- finite bounds, while a system of pure fixed (or pegged) rates is a band with zero bounds.

PDF Appendix II Fixed vs Flexible Exchange Rates

flexible) exchange rates can be thought of as an exchange rate band with in- finite bounds, while a system of pure fixed (or pegged) rates is a band with zero bounds.

PDF Appendix II Fixed vs Flexible Exchange Rates

Monetary Policy and Reserves Management under Pegged

pegged exchange rates, the nominal rupee-dollar exchange rate has had low volatility, while all other measures of the exchange rate have been more volatile. The rupee-dollar spot market is a pegged exchange rate.

PDF Appendix II Fixed vs Flexible Exchange Rates

Exchange-rate regime Wikipedia

Mr Alweendo discusses Namibia’s current exchange rate

Government Intervention – Download as Powerpoint Presentation (.ppt), PDF File (.pdf), Text File (.txt) or view presentation slides online. International Finance and Trade

Exchange-rate regime Wikipedia

0 of Exchange Rate Regimes Developing Countries

An exchange-rate regime is the way an authority manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, elasticity of labor market, financial market

International Monetary Reform and the ‘Crawling Peg’

The Vulnerability of Pegged Exchange Rates The British

An exchange-rate regime is the way an authority manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, elasticity of labor market, financial market

The Advantages and Disadvantages of Fixed Exchange Rates

Fixed Float or Intermediate Research Papers in Economics

exchange rate regime in the first half of the 1990s, the five East Asian na- tions that eventually ran into a crisis in 1997 had a rigid—de facto, pegged, or quasi pegged—exchange rate system …

Fixed exchange-rate system Revolvy

Economic Roundup The Treasury

The Mexican Peso Crisis Exchange Rate Policy and

A pegged exchange rate system is a hybrid of fixed and floating exchange rate regimes. Typically, a country will “peg” its currency to a major currency such as the U.S. dollar, or to a basket of

Economic Roundup The Treasury

versus (2) a rigid peg to the euro, versus (3) a rigid peg to the yen, versus (4) a rigid peg to the price of the leading export commodity of the country in question. The study offers a new proposal, called PEP, for Peg the Export Price.

Fixed Float or Intermediate Research Papers in Economics

Exchange-rate regime Wikipedia

Fixed Exchange Rate System Advantages and Disadvantages

country which pegged its exchange rate to gold, the others set their parities in terms of dollars and intervened in the dollar market. Thus the system evolved into

Canada’s Experience with a Flexible Exchange Rate in the

A World of Multiple Monies PIIE

Investor’s List Countries with Fixed Currency Exchange Rates

When the Bretton Woods system of fixed exchange rates failed in 1973, Australia’s banks and capital markets were underdeveloped compared to those in America and the U.K. Fearing instability in the Australian banking system, authorities decided to retain a fixed exchange rate.

New Zealand History of Monetary and Exchange Rate Regimes

The Advantages and Disadvantages of Fixed Exchange Rates

Brazilian case, the exchange rate system was a managed peg, or what is normally called a crawling peg. That is, the country moved the value of the new currency by a target amount, estimated at 8

Investor’s List Countries with Fixed Currency Exchange Rates

Monetary Policy and Reserves Management under Pegged Exchange Rate Arrangement: Nepal’s Experience Paper presented by Dr. Yuba Raj Khatiwada, Governor, Nepal Rastra Bank at a program organized by Royal Monetary Authority of Bhutan, Thimphu 28 August 2014 Background 1. After the breakdown of the Bretton Wood system in 1973, many advanced countries have adopted the market determined exchange

Does the Exchange Rate Regime Affect the Economy?

International Monetary Reform and the ‘Crawling Peg’

system is at best subordinated to exchange rate policy, as domestic credit creation must be kept within limits in order to ensure a sufficient volume of net foreign assets of the banking system. In monetary

International Monetary Reform and the ‘Crawling Peg’

XCHANGE ATE YSTEMS IN ERSPECTIVE Alan C. Stockman

The Mexican Peso Crisis Exchange Rate Policy and

Government Intervention – Download as Powerpoint Presentation (.ppt), PDF File (.pdf), Text File (.txt) or view presentation slides online. International Finance and Trade

Fixed Exchange Rate Definition Pros Cons Examples

An exchange-rate regime is the way an authority manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, elasticity of labor market, financial market

Fixed Float or Intermediate Research Papers in Economics

Choice Of Exchange Rate Regimes For Developing Countries April 2001 Africa Region Working Paper Series No. 16 Abstract The choice of an appropriate exchange rate …

The Brazilian Exchange Rate Conundrum RealClearMarkets

Investor’s List Countries with Fixed Currency Exchange Rates

This system is known as the par value system of pegged exchange rate system. Under this system, each member country of the IMF was required to define the value of its currency in terms of gold or the US dollar and maintain (or peg) the market value of its currency within ± …

HISTORY OF MALAYSIAN EXCHANGE RATE Academia.edu

Fixed Exchange Rate Definition Pros Cons Examples

pegged exchange rates in the early 1970s and the emergence of capital account crises in the 1990s on the back of rapid growth in private capital flows. A defining change was the breakdown of the Bretton Woods system of

The Vulnerability of Pegged Exchange Rates The British

Fixed vs. Pegged Exchange Rate Systems Investopedia

Choosing an exchange-rate system Bates College

This system is known as the par value system of pegged exchange rate system. Under this system, each member country of the IMF was required to define the value of its currency in terms of gold or the US dollar and maintain (or peg) the market value of its currency within ± …

Government Intervention Fixed Exchange Rate System

Floating Exchange Rates Experience and Prospects

a pegged exchange rate. With interest rates, in real terms, generally held quite low there was a fairly heavy reliance 4 Unsurprisingly, the REER was a lot more stable during this period, as the adjustment to nominal exchange rate was made to offset inflation differentials. 5 For a comprehensive overview of past monetary regimes in New Zealand, see Monetary Policy and the New Zealand Financial

(PDF) Floating Exchange Rate Regime ResearchGate

Exchange Rate Regime Does it Matter for Inflation?

The Operation and Demise of the Bretton Woods System 1958

pegged exchange rates, the nominal rupee-dollar exchange rate has had low volatility, while all other measures of the exchange rate have been more volatile. The rupee-dollar spot market is a pegged exchange rate.

Government Intervention Fixed Exchange Rate System

Brazilian case, the exchange rate system was a managed peg, or what is normally called a crawling peg. That is, the country moved the value of the new currency by a target amount, estimated at 8

The advantages and disadvantages of various exchange rate

Chapter III CHOOSING AN EXCHANGE RATE REGIME FOR VIETNAM

A World of Multiple Monies PIIE

exchange rate system of the structural adjustment years had been abandoned, and a system of fixed or pegged exchange rates instituted. However, following the …

Fixed vs. Pegged Exchange Rate Systems Investopedia

system is at best subordinated to exchange rate policy, as domestic credit creation must be kept within limits in order to ensure a sufficient volume of net foreign assets of the banking system. In monetary

The Brazilian Exchange Rate Conundrum RealClearMarkets

Some of the major types of foreign exchange rates are as follows: 1. Fixed Exchange Rate System 2. Flexible Exchange Rate System 3. Managed Floating Rate System. 1. Fixed Exchange Rate System (or Pegged Exchange Rate System). Fixed exchange rate system refers to a system in which exchange rate for a

Exchange-rate regime Wikipedia

Assessing China’s Exchange Rate Regime

Fixed Float or Intermediate Research Papers in Economics

(1999) that exits from pegged exchange rate regimes have been accompanied by output declines. In addition, they show that exits from long-lasting pegs, both orderly and disorderly, appear to be accompanied by particularly large falls in economic activity.

Exchange Rate Regimes in the Modern Era Fixed Floating

What are the main advantages and disadvantages of Fixed

Fixed Exchange Rate Definition Pros Cons Examples

External Shocks and Collapsing the Pegged Exchange Rate System† Hua Yu Sun (孙华妤)a, b and Yue Ma (马跃)a, c* a Associate Professor, Department of Economics,

Fixed vs. Pegged Exchange Rate Systems Investopedia

0 of Exchange Rate Regimes Developing Countries

Fixed Exchange Rate System Advantages and Disadvantages

When the Bretton Woods system of fixed exchange rates failed in 1973, Australia’s banks and capital markets were underdeveloped compared to those in America and the U.K. Fearing instability in the Australian banking system, authorities decided to retain a fixed exchange rate.

HAS AUSTRALIA’S FLOATING EXCHANGE RATE REGIME BEEN

Fixed exchange-rate system Revolvy

Fixed exchange rates: A metallic standard leads to fixed exchange rates. In a gold standard, each country determines the gold parity of its currency, which fixes the exchange rates between countries. In a reserve currency system, the reserve currency has a gold parity, and all other currencies are pegged to the reserve currency, which also leads to fixed exchange rates. Fixed exchange rates

IXED VERSUS LOATING XCHANGE ATES Peter B. Kenen

wish to peg their exchange rates but sometimes have floating rates thrust upon them. On three occasions during the twentieth century—the breakup of the international gold standald in the l930s, the breakup of the Bretton Woods system in the 1970s and most recently the exo-dus of countries (notably Britain) from the ex-change rate mechanism (ERM) of the European Economic Community (EEC

Fixed Float or Intermediate Research Papers in Economics

Choosing an exchange-rate system Bates College

HAS AUSTRALIA’S FLOATING EXCHANGE RATE REGIME BEEN

greater policy discipline imposed by the regime. Even a pegged exchange rate country with an initially high inflation will eventually, through the discipline effect, enjoy a low inflation rate.

Difference Between Fixed and Flexible Exchange Rates (with

pegged exchange rates, the nominal rupee-dollar exchange rate has had low volatility, while all other measures of the exchange rate have been more volatile. The rupee-dollar spot market is a pegged exchange rate.

Exchange Rate Regime Does it Matter for Inflation?

Assessing China’s Exchange Rate Regime

Fixed exchange rate regime: • In the medium run, the real exchange rate is determined by the relative price of foreign to domestic goods, regardless of regime.

The Brazilian Exchange Rate Conundrum RealClearMarkets

Monetary Policy and Reserves Management under Pegged

The Vulnerability of Pegged Exchange Rates The British

FEDERAL RESERVE BANK OF ST. LOUIS 2. By spreading exchange rate adjustments over long periods, the “crawling peg” system would avoid the periodic exchange crises and un-

Economic Roundup The Treasury

Pegged Exchange Rate Regimes- A Trap?

Pegged Exchange-Rate Arrangement a. but some nations maintain more stable exchange rates by tying their currencies to other currencies 1. Many small countries peg their currencies to the dollar. currency realignments were infrequent and inflation was controlled. they created the European monetary system (EMS) to stabilize exchange rates. there emerged several efforts to manage exchange rates

Monetary Policy and Reserves Management under Pegged

Exchange Rate Regimes and Inflation Evidence from India

board arrangements, other conventional fixed peg arrangements, pegged exchange rates within horizontal bands and conventional pegs. “Crawling peg” includes exchange rates within crawling bands, crawling pegs and crawl-like arrangements.

pegged exchange rate or fixed exchange rate Investopedia

Fixed vs. Pegged Exchange Rate Systems Investopedia

International Monetary Reform and the ‘Crawling Peg’

External Shocks and Collapsing the Pegged Exchange Rate System† Hua Yu Sun (孙华妤)a, b and Yue Ma (马跃)a, c* a Associate Professor, Department of Economics,

Fixed Exchange Rate Definition Pros Cons Examples

focus is on the “modern era” since the Bretton Woods system (of widespread pegged exchange rates) finally collapsed in 1973. The authors provide a simple theoretical framework for their

Fixed Float or Intermediate Research Papers in Economics

Economic Roundup The Treasury

Australia’s Transition to Floating Exchange Rate System

Floating Exchange Rates: Experience and Prospects WITH THE ABANDONMENT of fixed dollar exchange rates in March 1973, the world’s industrialized countries adopted temporarily a system …

Economic Papers Series Paper No. (1) dof.gov.ae

Pegged Exchange Rate Definition & Example InvestingAnswers

When the Bretton Woods system of fixed exchange rates failed in 1973, Australia’s banks and capital markets were underdeveloped compared to those in America and the U.K. Fearing instability in the Australian banking system, authorities decided to retain a fixed exchange rate.

Chapter III CHOOSING AN EXCHANGE RATE REGIME FOR VIETNAM

115 AN ANALYSIS OF PEGGED EXCHANGE RATE BETWEEN BHUTAN AND INDIA Karma Galey* Abstract This paper analyzes the applicability of the theory of optimum

Fixed Float or Intermediate Research Papers in Economics

Fixed exchange rates: A metallic standard leads to fixed exchange rates. In a gold standard, each country determines the gold parity of its currency, which fixes the exchange rates between countries. In a reserve currency system, the reserve currency has a gold parity, and all other currencies are pegged to the reserve currency, which also leads to fixed exchange rates. Fixed exchange rates

Fixed Float or Intermediate Research Papers in Economics

(PDF) Floating Exchange Rate Regime ResearchGate

Canada’s Experience with a Flexible Exchange Rate in the

Definition of Fixed Exchange Rate. An exchange rate regime, also known as the pegged exchange rate, wherein the government and central bank attempts to keep the value of the currency is fixed against the value of other currencies, is called fixed exchange rate.

IXED VERSUS LOATING XCHANGE ATES Peter B. Kenen

The Operation and Demise of the Bretton Woods System 1958

A World of Multiple Monies PIIE

exchange rate system of the structural adjustment years had been abandoned, and a system of fixed or pegged exchange rates instituted. However, following the …

0 of Exchange Rate Regimes Developing Countries